Tag: econometrics

-

The Role of Econometrics in Shaping Post-Pandemic Economy Policies

The post-pandemic economy presents unprecedented challenges and opportunities. From employment disruption to inflation, governments worldwide are grappling with rebuilding economies while preparing for future shocks. This article explores how econometric analysis is driving smarter policymaking in five critical areas, helping nations transition toward a resilient and inclusive post-pandemic economy. 1. Measuring the COVID-19 Shock with…

-

AIC BIC Model Selection in Econometrics

AIC BIC Model Selection: A Core Concept in Econometrics AIC BIC model selection plays a vital role in choosing the most appropriate model in econometrics. These information criteria help compare models by balancing complexity and goodness-of-fit, ultimately improving forecasting and decision-making. Understanding AIC The Akaike Information Criterion (AIC) is calculated as: AIC = 2k -…

-

Simultaneous Equation Models Econometrics – Full Guide

Simultaneous equation models econometrics represent one of the most critical frameworks for analyzing systems of interdependent relationships in economic theory. These models are particularly valuable when endogenous variables influence each other reciprocally, a condition not handled well by single-equation models. Understanding these models is crucial for researchers and practitioners aiming to derive consistent and unbiased…

-

Top 7 Proven Econometric Forecasting Methods to Boost Your Accuracy

Forecasting with Econometric Models Published in: Econometric Models Table of Contents Introduction to Econometric Forecasting Key Econometric Forecasting Models Applications of Econometric Forecasting Case Study: Forecasting GDP Growth Challenges in Econometric Forecasting Conclusion References Introduction to Econometric Forecasting Econometric forecasting is a systematic approach to predicting future economic events using statistical methods and economic theories.…

-

Ultimate Guide to Panel Data Econometrics: Top 5 Insights on Fixed vs Random Effects

Ultimate Guide to Panel Data Econometrics: Top Insights on Fixed vs Random Effects Category: Panel Data Econometrics | Tags: panel data, fixed effects, random effects, regression models, econometrics Panel Data Econometrics: Fixed and Random Effects Excerpt: Explore this ultimate guide to panel data econometrics and uncover top insights comparing fixed and random effects models, their…

-

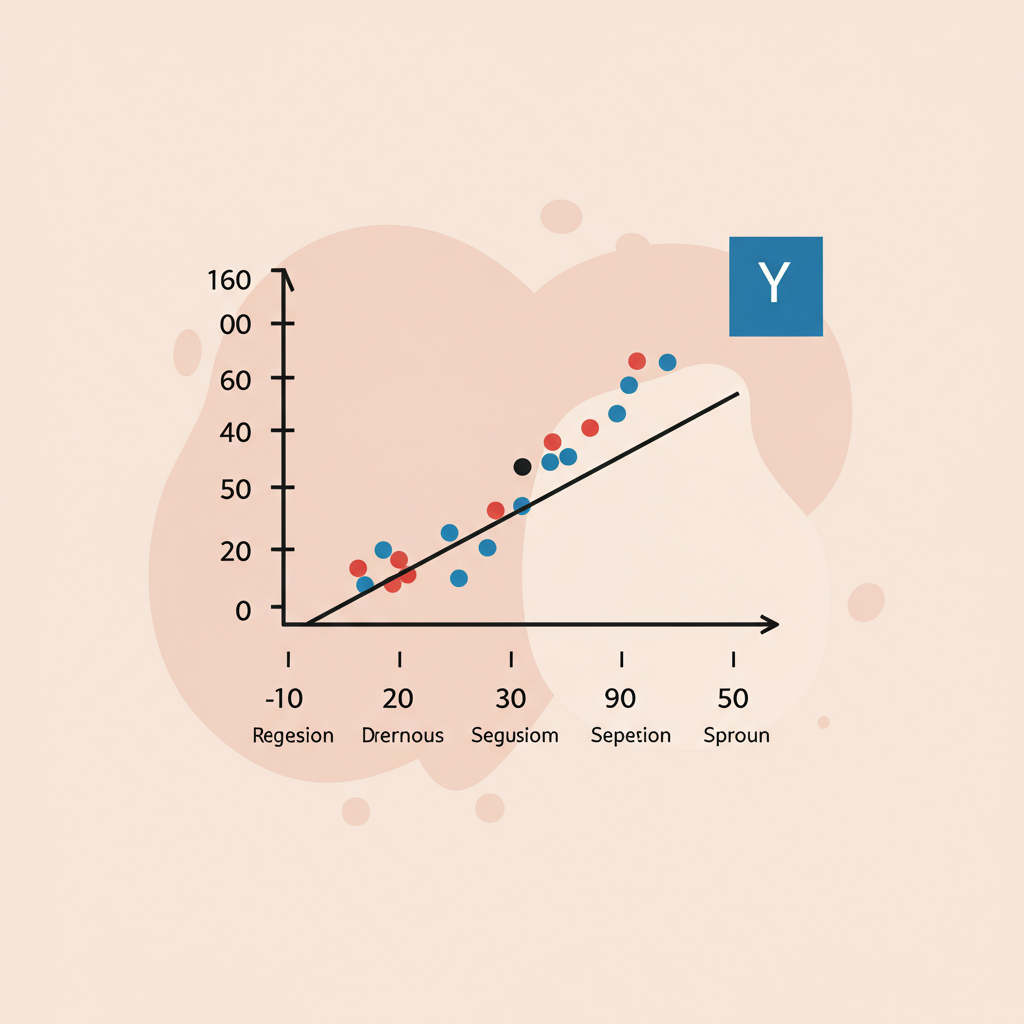

Top 7 Powerful Insights into Linear Regression Econometrics You Must Know

Linear Regression in Econometrics: Assumptions, Problems & Solutions Published on May 24, 2025 Excerpt: This article explores the foundation of linear regression econometrics, its critical assumptions, common pitfalls such as multicollinearity and heteroskedasticity, and best practices for robust model validation and estimation. Table of Contents Introduction Key Assumptions in Linear Regression Diagnostic Checks: Multicollinearity &…